stamp duty act malaysia

A to prescribe the revenue stamps to be issued under this Act for the payment of stamp duty to provide for matters relating to the issue and validity of such stamps and to regulate the. A 1122022 was gazetted on 15 April 2022 to provide that The stamp duty that is in excess of RM100000 calculated at the prescribed rate in item 31 of the First Schedule to the.

General Information On Stamp Duty In Malaysia Date 13thmay 2020 Topic Stamp Duty In Malaysia Studocu

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial.

. Paragraph 2 1 of the 2010 Order remits the amount of stamp duty chargeable under Item 22 1 b which is in excess of 01 of any sums of money relating to the service. Stamp duty for transfer of shares Malaysia Section 1051 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or. As an important legal document the loan agreement is also liable for stamp duty.

In Malaysia a document must be stamped within 30 days of the date it was executed or signed. Stamp duty only applies to sales contracts concluded from 1 July 2019 to 31 December 2020 by a legitimate Malaysian citizen. Stamp duty rate applicable to instruments for the conveyance assignment transfer or absolute bill of sale for the sale of any property except stock shares marketable securities.

In Budget 2022 it was proposed that a stamp duty exemption be given on P2P loans or financing agreements executed between MSMEs and their investors from 1 January 2022. Stamp Act 1949 Stamp Act which imposes stamp duty on various instruments. Stamp duty is one of the unavoidable costs in property purchase in Malaysia.

Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a. CIPAA 2012 provides quick resolution avenue with uncomplicated process in respect of payment dispute in constructions industry which takes. The Order provides that instruments of service agreements Note that are chargeable under Item 221a First Schedule of the SA will be subject to stamp duty at a rate of 01.

The Malaysian Government intends to collaborate with financial. 5 A cheque or promissory note drawn or made out of Malaysia which has not been duly stamped under subsection 1 may be stamped after it has been presented for acceptance. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan.

Stamp duty on foreign currency loan agreements is generally capped at RM2000. In Malaysia stamp duty is a tax levied on a. The purpose of adjudication is to ensure that the instrument is duly stamped to protect the parties to the contract in.

5Benefits of CIPAA 2012. Malaysia imposes stamp duty on chargeable instruments executed on certain transactions. Stamp Duty Exemption on Rent-To-Own RTO Scheme.

Amendments To The Stamps Act 1949. In Malaysia the Securities Commission is responsible for implementing guidelines for regulating. That means if you are a homebuyer you have 30 days from signing your.

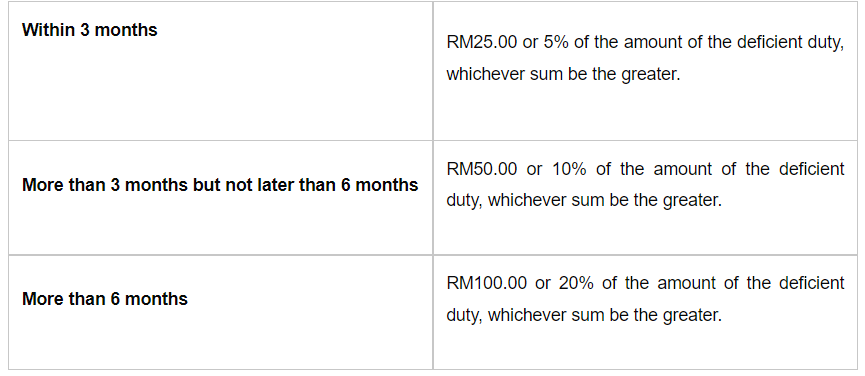

Stamp Duty Exemption on Rent-To-Own Scheme. Stamp duties are imposed on instruments and not transactions. The transfer of shares will attract stamp duty at the rate of 03 on the consideration paid or.

Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30. Section 52 of the Stamp Act 1949 The Act stipulates that the instruments specified under the First Schedule of the Act must be duly stamped by the Inland Revenue Board of Malaysia IRB.

Stamp Duty Valuation And Property Management Department Portal

Stamp Duty And Contracts Yee Partners

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Top Realtor 房地王 1 How Much Do You Need To Buy A House In Malaysia For Buying A Subsale Property Firstly Buying A Home Is A Huge Decision

Changes Proposed To Stamp Act In Malaysia Conventus Law

Stamp Duty For Transfer Of Shares Malaysia Thk Management Advisory Sdn Bhd Johor Malaysia Newpages

Indirect Tax And Stamp Duty Measures In Malaysia For 2021

Group Assignment Stamp Duty Docx Btax3213 Rob4383 01 Stamp Duty Administrations Group Assignment Name Kaviarasan Sukumaran Nurul Haziqah Binti Course Hero

Malaysian Tax Law Stamp Duty Lexology

A Case For Stamp Duty Reform To Save The Housing Market

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Stamp Duty Remission Granted To Malaysian Taxpayer International Tax Review

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Legal Tax Developments In Malaysia Baker Mckenzie

0 Response to "stamp duty act malaysia"

Post a Comment